I know that regulations and compliance are not everyone’s favourite topics, but there’s a new regulation in the U.K. with the potential for massive advantages in financial services.

Achieving compliance has traditionally been quite simple: follow the rules and regulations to a tee, and you’re good to go. Yet, the Financial Conduct Authority’s (FCA) new Consumer Duty introduces a new form of regulation with an outcome-based structure.

With the Duty, the FCA’s goal is to ensure financial services firms put the customer at the heart of their business approach and overall strategy, leading to the best possible outcomes for customers and supporting them to achieve their financial objectives.

Initially, the Consumer Duty regulations may seem like just another compliance hoop to jump through, but the shift in mindset it ignites will open up enormous opportunities for financial services firms and significant benefits for their customers.

Let’s deep dive to find out how.

What does the FCA expect from financial service firms?

In a nutshell, all firms must—first and foremost—take action to deliver good outcomes for customers.

These actions include monitoring and testing that good outcomes are being achieved across products and processes by reviewing a range of different data sources, such as complaints, retention levels, product cancellation rates, vulnerability reviews, end-to-end customer journey reviews, net promoter scores, social media comments, and any other Voice of the Customer sources.

Moreover, from July 2024, each firm must deliver an Annual Board Report to evidence how it is delivering these positive outcomes, plus how its overall strategy, purpose and values do the same.

The FCA will continue to conduct periodic reviews and Consumer Duty testing on firms to measure their overall performance against the outcomes. These assessments are likely to reveal gaps that will need to be solved from both a remediation and a fix-forward perspective.

In other words, firms of all sizes are discovering that having complete control and an overall view of their customers’ outcomes will take a lot more effort and focus than they originally anticipated.

The immediate challenges of Consumer Duty compliance

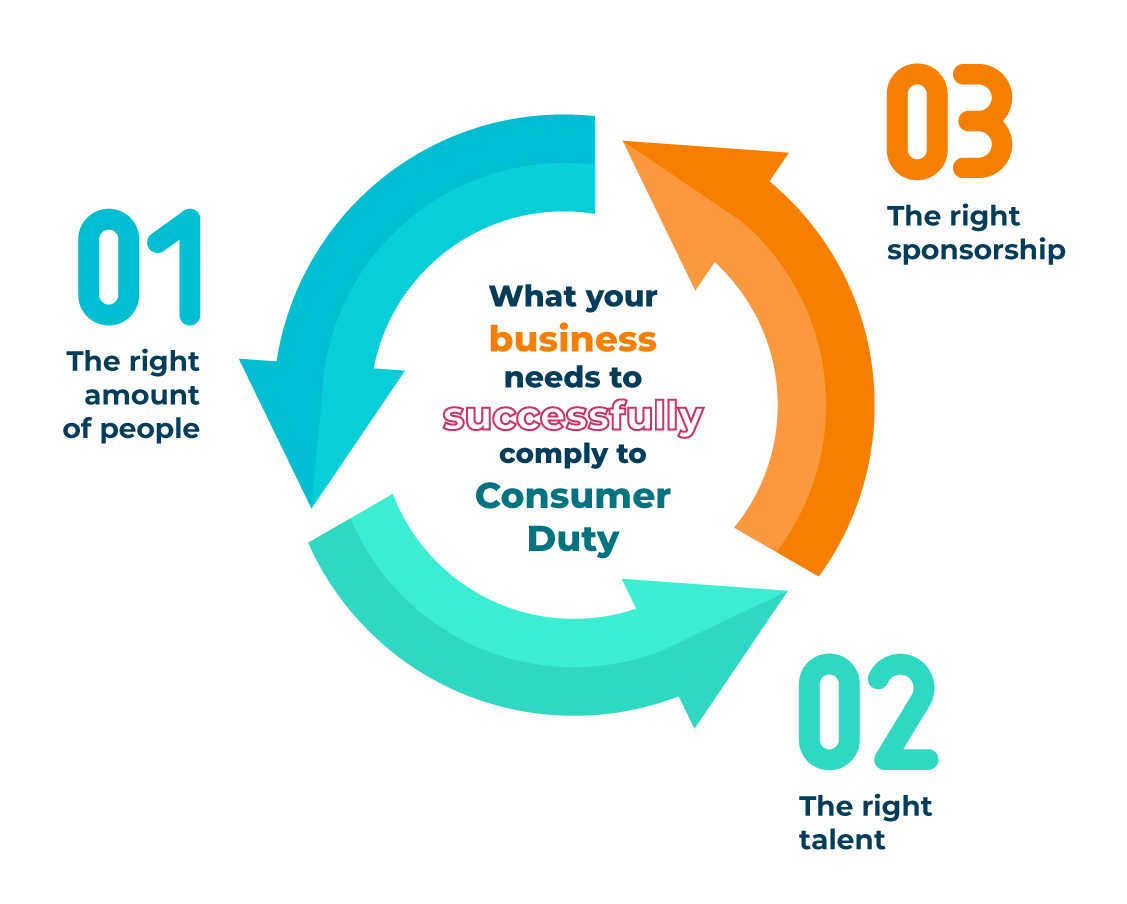

Clearly, Consumer Duty compliance requires a lot of effort, which means firms will need the right amount of people, the right talent, and the right sponsorship to drive this through.

The first Annual Board Report is due in July 2024, when board members must attest to the fact that their organisation is genuinely monitoring and positively improving customer outcomes. Plus, it will take time and strategic planning to identify the evidence and develop iterative improvements, creating more deadlines and putting strain on the organisation.

Following each annual summary, any remediation work will be resource-intensive and take people away from their usual tasks, which means less focus on the firm’s core business. Even as firms develop and mature into their Consumer Duty responsibilities, maintaining positive outcomes for customers, meeting reporting deadlines, and fixing any issues will still require resources, which means advance planning, training, and ongoing monitoring.

Plus, analysing a mix of quantitative and qualitative data sources takes a unique set of skills and experience to draw the right insights and take action. Blending technology and talent here is crucial in delivering this most effectively.

Okay, so how is this a win-win?

Despite the amount of work involved, the potential upside for understanding your customers’ experiences and improving outcomes for them is vast.

Customer complaints are a prime example. As firms more rigorously review complaints received, they will better understand the end-to-end journey that each complainant followed. These rich insights will highlight the good and the bad in the customer journey and empower firms to put things right quickly.

When things go wrong for customers, the solutions are rarely rocket science. Most commonly, it’s simply a case of one end of the process not aligning perfectly with the other, either from a people or process perspective. The tricky bit is shining a light in the right place to identify the problem, particularly when firms are struggling with bandwidth or lack the focus to manage Consumer Duty properly and well.

But it is so worth it!

Imagine being able to understand what frustrates your customers and fixing these for the next customers. That would not only deliver your Consumer Duty evidence but also, most importantly, solve your customer friction points, ultimately leading to increased customer satisfaction, retention, and brand advocacy.

That’s your win-win right there.

How can Concentrix + Webhelp help?

Concentrix + Webhelp is one of the leading financial services customer experience (CX) players in the U.K. market. We have decades of experience providing the right talent, technology, and thinking to solve challenges and deliver positive outcomes for your customers.

On the people front, we can create a team to help with any or all aspects of your Consumer Duty responsibilities. Outcomes testing, complaints analysis, and end-to-end customer journey reviews are all elements where we can land a team of people to deliver quickly and efficiently.

We can also provide teams to deal with any remediation projects to ensure your internal teams can focus on maximising the value of their business-as-usual activities.

When it comes to technology, we can deploy the tools and solutions you need to drive the right insights to evidence your Consumer Duty outcomes. We can also help you strategise, design, and build your overall approach to this new regulation, so there’s no need to go it alone.

Remember, get it right, and it will pay dividends for both your customers and your organisation.

Contact us today, and let us help you solve this new compliance challenge (we promise it’s far more exciting than it sounds).